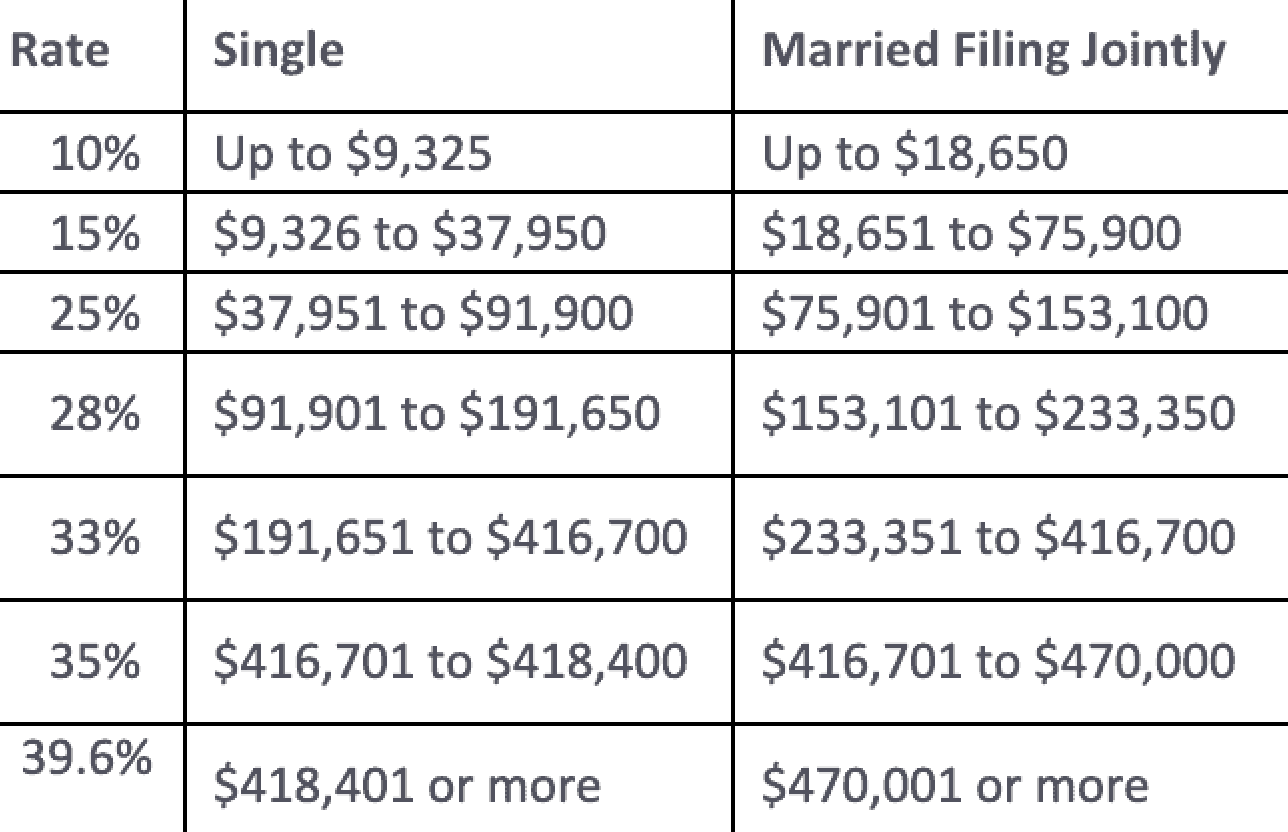

Tax Brackets 2025 Irs - Irs Tax Brackets 2025 Single Phaedra, For example, a married couple whose total income minus deductions is $250,000 would have had a 33% tax rate in 2025, but only 24% in 2025. These are the tax rates you will pay in 2025 based on the amount you earn next year. Find out your 2025 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married individuals filing separate returns, and estates and trusts.

Irs Tax Brackets 2025 Single Phaedra, For example, a married couple whose total income minus deductions is $250,000 would have had a 33% tax rate in 2025, but only 24% in 2025. These are the tax rates you will pay in 2025 based on the amount you earn next year.

IRS Sets 2025 Tax Brackets with Inflation Adjustments, Below, cnbc select breaks down the updated tax brackets for 2025 and what you need to know about. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Tax Brackets 2025 Explained Meaning Fiann Ernestine, 2025 tax brackets (taxes due in april 2025) the 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets: These are the same tax.

New Irs Tax Brackets 2025 Dore Nancey, For 2025, inflation adjustments increased the size of tax brackets by about 5.4%. However, for the 2025 tax year (pertaining to taxes filed in 2025), the irs is implementing adjustments to the income thresholds associated with these brackets.

Tax Brackets 2025 Irs. In the united states, there are seven federal tax brackets with marginal rates of 10%, 12%, 22%, 24%, 32%, 35%, and 37%, which remain consistent with the rates established in 2023. The irs is introducing new income limits for its seven tax brackets, adjusting the thresholds to account for the impact of inflation.

Irs Tax Bracket 2025 Table Tina Adeline, The highest earners fall into the 37% range, while those who earn the. However, for the 2025 tax year (pertaining to taxes filed in 2025), the irs is implementing adjustments to the income thresholds associated with these brackets.

2025 Tax Brackets Vs 2025 Tax Tables Irina Angelica, There are seven tax brackets for most ordinary income for the 2023 tax year: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

2025 Brackets and Rates Bernardi Securities, Below, cnbc select breaks down the updated tax brackets for 2025 and what you need to know about. All eas are on significant income tax.

2025 Tax Brackets IRS Makes Inflation Adjustments Modern Wealth, As your income goes up, the tax rate on the next layer of income is higher. The irs is introducing new income limits for its seven tax brackets, adjusting the thresholds to account for the impact of inflation.

If uncertain concerning filing status, see irs publication 501 for details. To do so, all you need to do is:

See current federal tax brackets and rates based on your income and filing status.

2025 Federal Tax Brackets For Payroll Dixie Frannie, Tax brackets and tax rates. To do so, all you need to do is: